GMG HNW Solutions Introduces Listed Share Financing

GMG Presents...

Mortgages for Luxury French Property with...

100% Purchase Price Financing!

THE ALLURE OF THE FRENCH RIVIERA

Nestled on France's southern coast, near the Italian frontier, the French Riviera showcases some of the most enchanting towns you could envision. With its chic allure, this region has magnetized celebrities for generations. Boasting approximately 300 sunlit days annually, its climate is nothing short of ideal. From designer boutiques, to the array of nearly 40 Michelin-starred restaurants, it's a destination of elegance. It's also a thriving community of English and American expatriates.

TOP DESTINATIONS FOR PROPERTY OWNERS

Surrounded by both the majestic mountains and the serene sea, the Riviera promises a perfect balance. While the coast will be your regular retreat, snow-capped peaks are always within reach for a winter getaway. Explore the top places to reside in the Riviera:

Now to the good stuff....

FINANCING FOR FOREIGN NATIONALS

Problem: Securing financing for Foreign Nationals to purchase property in France has always been difficult - time zone, language, lack of understanding for both lender and borrower, and other issues. Most banks and financing institutions are not focused on Foreign Nationals as the domestic market is strong, and they have enough business to satisfy them.

The GMG Solution: Our GMG European Lender Acquisition team has worked with a few smaller private banks to create a financing solution for our international clientele with a structure that suits their specific needs.

ELIGIBILITY AND REQUIREMENTS

For Foreign Nationals seeking finance in this exclusive domain, banks have set specific benchmarks to evaluate potential candidates.

1. Geographical Preference

2. Property Type

3. Loan Size

4. Our 100% LTV Solution!

5. Age Bracket

6. Financial Overview

HOW IT WORKS

Example

Purchase price: €1,000,000

Loan amount: €1,000,000 (100% LTV)

Interest rate: 4.50%

Loan duration: 20 years

Loan type: Principal + Interest

Investment amount: €500,000 (50% of loan amount)

Investment return: 4.50% Compounded

Mechanics

The 100% LTV mortgage

€1,000,000 @ 4.50% for 20 years

= Total mortgage interest PAID = €518,359

The interest-earning investment for 50% of loan amount

€500,000 investment @ 4.50% “Compounded” for 20 years

= Investment value end of Year 20 = €1,205,000 - €500,000 principal

= Total interest EARNED = €705,000

€705,000 EARNED - €518,359 PAID

= Net POSITIVE cash flow = €186,641

That is to say, the bank will give you a positive carry-trade for using their mortgage, and not only is the mortgage FREE, you MAKE money!

THE PURCHASE PROCESS

Navigating property acquisition in France is smoother with the guidance of a property buyer's agent familiar with the region and the nuances of French property transactions. Once you've found your dream home, the steps are as follows:

In conclusion, owning a home in the South of France is now achievable for non-residents with our new GMG Luxury France Mortgages! I hope I get an invite to visit you one day!

Global Mortgage Group offers innovative financing solutions to meet the diverse needs of our global clientele, including Overseas Expats, Foreign Nationals, Family Offices, Investment Funds, High-Net-Worth Clients, and Private Banks. Contact us at hello@gmg.asia to start your Riviera investment journey today!

If you have any questions, please feel free to contact me directly at donald@gmg.asia or my personal mobile +65 9773-0273.

Global Mortgage Group (GMG), a leading international mortgage originator, is proud to announce the successful funding of a $38.5 million asset-based bridging loan for a luxury Good Class Bungalow (GCB) property in Singapore. The loan enabled the owner to complete the acquisition of another company by leveraging on this prime real estate.

With a strong commitment to empowering Singapore real estate investors and homeowners with bespoke financial solutions, GMG specialises in catering to the unique needs of high-net-worth (HNW) individuals and foreigners seeking to access liquidity without the need for a deep dive into personal and company financials. GMG offers these customised liquidity solutions worldwide, including U.S.A., Australia, U.K., Canada, Thailand, Philippines, Hong Kong, and Dubai.

Located in one of Singapore's most sought-after neighbourhoods, the GCB offers unrivalled luxury and privacy, making it a prime investment in Singapore's thriving property market. The loan was structured to meet the client's funding needs and exit timeline at a 72% LTV (loan-to-value) with an 18-month interest servicing-only tenor. This closing marks GMG's successful funding in excess of over $350 million in bridging loans in Singapore this year alone.

"We are thrilled to have facilitated this substantial asset-backed bridge loan for our client. Our team of experienced financial analysts structured a tailored solution that met the client's specific requirements, enabling them to capitalise on this unique investment opportunity to expand their business. From the initial discussion to funding, the process took only 12 days." said Madel Tan, Singapore Head for Global Mortgage Group. "We have seen an upward trend in market demand for bridging loans that offer flexibility and liquidity to our HNW clients."

GMG's expertise in providing efficient asset-based bridge loans for high-value properties allows their clients access to an extensive network of lenders with bespoke programs. Their commitment to excellence extends to simplifying what is often a complex real estate transaction.

About Global Mortgage Group:

Global Mortgage Group is a leading international mortgage originator that specialises in offering customised financial solutions for high-net-worth individuals and foreign investors. With a track record of successfully funding significant real estate transactions in Singapore and globally, Global Mortgage Group provides flexible and personalised mortgage options to meet the diverse needs of its clients worldwide.

For more information, please visit www.gmg.asia or get in touch with Madel Tan, Director and Head of Singapore at, +65 9634 5623 or madel.tan@gmg.asia.

As you may have read in our previous emails, real estate bridging loans have been the most active part of our business this year as traditional bank financing has tightened globally.

When the need for liquidity arises with a short time window to fund, we can use the value of the property as collateral for a short-term loan.

In Singapore, we are the leaders in high-value real estate bridging financing for HNW individuals, with nearly $400M in funded bridging finance deals YTD. For more details, refer to our recent press release highlighting a recent transaction.

We offer short-term asset-backed loans against real estate in: USA, Singapore, Canada, UK, HK, Thailand, Philippines, and Australia.

Now, we have another asset-backed solution!

Listed shares…..

What is listed-share financing?

Simply put, share financing helps investors by utilizing their existing shares to fund new investments without having to sell any of their shares.

Capitalization through investment, a stock loan, or other liquidity and financing transactions allows owners of publicly traded stock the flexibility to gain access to the locked-up value of their freely traded stock position.

GMG Share Financing is designed specifically for corporations, its employees, officers, and major holders of publicly traded companies while providing total privacy to our clients.

Our process is quick, transparent, and completely confidential.

Financing proceeds can be used for personal or business purposes or to diversify or hedge current stock positions.

Funding is quick, with a transaction closing in as little as 3 to 7 business days.

Terms of providing you with liquidity and funding are based on evaluation of the risk and future performance associated with the securities involved in the transaction.

The transaction term is typically three years, with Interest payments or Maintenance Fees on a quarterly or semi-annual basis.

Financing and provision of liquidity are interest only or accompanied by modest Maintenance Fees, and additionally, are non-recourse.

The recipient of funding has the option of simply walking away at any time with no further liability and no personal or corporate guarantees.

In the event of a default, there is no report to any credit bureaus or governmental agencies, nor is there a file of public notice. There is no adverse consequence to the client’s credit.

Listed share financing is available in:

Asia, Australia, Canada, Europe, Mexico, South America, and the Middle East.

Our Lenders

Our stock lenders are privately held asset-based lending companies that provide individuals and institutions with flexible, customized non-recourse high-value stock loans.

When Banks say NO, we say YES!

Our lenders are also uniquely positioned to provide stock loans and secured share financing even when banks, brokerage firms, and securities houses are unwilling or unable to do so; this is due to their global market reach, extensive relationships, and applicable jurisdictional law.

Benefits of GMG Share Financing

Transaction Process

1. Submit a stock for a quote

2. Term Sheet issued

3. Term Sheet signed

4. KYC info for shareholder and shareholder info provided to the Lender

5. Agreement provided to Shareholder

For specific information on rates and terms, please reach out to our team at hello@gmg.asia or contact me directly at +65 9773-0273.

Considered the “bible” for foreign investor trends in U.S. residential real estate, the 2023 National Association of Realtor’s report on Foreign Investments has just been released, and the results are eye-opening!

This is why we got into this business in 2017!

Problem: Foreign Investors found it difficult to securing financing for their U.S. real estate investments.

That is when we started on our journey to fix this!

Watch our DemoDay Presentation!

Before we start...

If I told you that in a year that saw:

And I said U.S. real estate purchased by foreigners was ONLY 10% LESS THAN the previous year.

Would you believe me?

Of course not!

Frankly, this report surprised me but states the resilience of the U.S. real estate market, especially with foreign investors and overseas investors.

If you have any questions about this report or anything real estate financing-related, please feel free to reach out to me directly at donald@gmg.asia or my personal mobile +65 9773-0273.

Sincerely,

Donald Klip, Co-Founder

Global Mortgage Group

Before we begin, I want to thank our summer intern, Angelina Hong, who is currently reading the Classics at the University of Oxford in the UK and the author of this report and many of our previous articles. We wish her the best in her future endeavours!

International Buyers of U.S. Real Estate: 2023 Highlights

In the ever-evolving landscape of global real estate investment, the United States remains a sought-after destination for international buyers. The year 2023 has brought about significant changes and trends in the international real estate market, with foreign buyers continuing to play a vital role. This article explores the statistics and key factors driving the international buyers of U.S. real estate in 2023.

Key Statistics (April 2022-March 2023):

$53.3 billion of foreign buyer purchases

84,600 foreign buyer existing-home purchases

Average foreign buyer purchase price rose to $639,900

Top foreign buyer: China

Top destination: Florida

Part I: Strong U.S. Housing Demand, Tight Supply, Soaring Home Prices

The United States housing market has experienced its own set of dynamics. In 2021, it witnessed the highest levels of home sales since 2006. However, 2022 saw a slowdown and normalisation of the market due to various factors. In response to inflationary pressures, mortgage rates were raised, which impacted housing demand.

As of the end of March 2023, the housing market faced challenges related to supply. Unsold homes were 4% above levels seen one year prior. The median price of existing homes also hit a notable milestone, reaching $375,700 in April 2023.

Part II: International Buyers

Purchases of Existing Homes

The 2023 statistics reveal a shift in the international buyer landscape. The number of existing homes purchased by foreign buyers decreased to 84,600, marking the lowest figure since 2009. This decline represents a 14% drop from the previous year, with 14,000 fewer foreign buyers participating in the market.

The dollar volume of foreign buyer purchases also decreased by 9.6% to $53.3 billion, reflecting the impact of market dynamics.

READ – still $53 billion of demand, despite the issues mentioned above!

Origin and Destination

The origin of international buyers continues to diversify. Asian buyers maintain their dominance, representing the largest group with a market share of 38%. Latin American buyers follow closely behind, accounting for 31% of the market. European and Canadian buyers hold 14% and 10% of the market share, respectively.

China remains the top country of origin for international buyers, representing 13% of the market. Chinese buyers stand out with the highest average purchase price at $1.2 million, often investing in expensive states such as California and New York. In contrast, Mexican buyers tend to purchase less expensive properties, with Texas being a preferred destination.

The top 10 countries of origin of international buyers:

1. China

2. Mexico

3. Canada

4. India

5. Colombia

6. United Kingdom

7. Australia

8. Germany

9. Venezuela

10. Israel

In terms of destinations within the United States, Florida remains the top choice for international buyers, with a significant 23% share of the market. California and Texas closely follow, each with a 12% share.

The top 10 states for international buyers:

1. Florida

2. California

3. Texas

4. North Carolina

5. Arizona

6. Illinois

7. New York

8. Ohio

9. Pennsylvania

10. New Jersey

Financing

Foreign buyers continue to exhibit a propensity for all-cash purchases, with 42% choosing this payment method, compared to 26% among all buyers of existing homes. Those foreign buyers residing abroad are more likely to make all-cash purchases.

Property as a Real Estate Investment

Foreign purchases of U.S. real estate saw 6% increase from the previous year, indicating a growing interest in real estate investment for various purposes.

READ: Year-on-year INCREASE in property purchased for investment purposes!!!

The majority of foreign buyers prefer detached single-family homes, with 76% making such purchases. Additionally, foreign buyers tend to gravitate towards suburban areas, with 45% choosing this type of location. Interestingly, more than three-quarters of Asian Indian buyers opt for suburban properties. Conversely, Canadian buyers are more likely to purchase properties in resort areas for use as vacation homes.

Part III: Reasons for Not Purchasing U.S. Property

Despite the allure of U.S. real estate, some international clients cite their perception of hurdles for investing in this sector.

Here are the common misconceptions, the actual facts and our solutions:

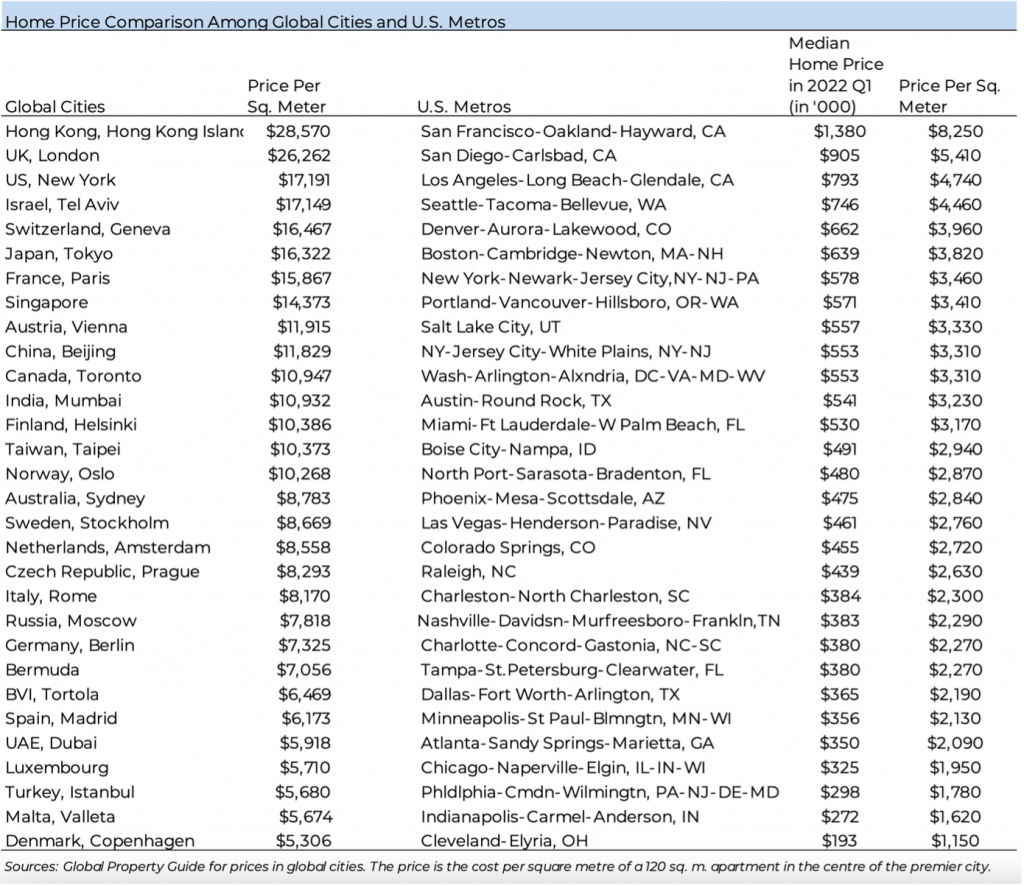

| Cost of properties | Not at all. See the following chart on price comparisons to global cities |

| Difficulties in finding suitable properties | This can be an issue with time zones, which sites to look at etc. We have fixed this – AM Property Finder. |

| Immigration Laws | As a foreign real estate investor, there are NO restrictions! |

| Challenges in obtaining financing | This is all we do. Check out our Foreign National loan programs. |

| Property taxes | You earn income, you need to pay taxes; however, there are many ways to deduct expenses to maximise your rental income. |

| Exposure to U.S. tax laws | The reality of U.S. taxes is MUCH EASIER than perception. Some states, like Texas, don’t have state taxes, which is why it’s one of the most popular investment destinations. Also, there are many ways to deduct expenses to maximise your rental income. |

| Maintenance fees | Any real estate investment will have maintenance required, but that is why you pay a small fee to the property manager. AM Concierge service can introduce you to our preferred managers to make your investment seamless and hassle-free. |

| Currency transfer difficulties | No issues here. AM Concierge service has partner remittance firms that help our clients. Even in China we have viable solutions from our partners. |

| Insurance | Insurance is a small percentage of the rental income you receive, and we have partners to help you with this. |

| Exchange rate concerns | If you are funding the mortgage payments in your home currency, you may experience a currency loss, BUT you can easily hedge this, PLUS you will be earning USD rental income. |

America Mortgages Concierge Services:

In conclusion, the 2023 statistics on international buyers of U.S. real estate demonstrate a changing landscape influenced by global economic conditions, supply and demand dynamics, and evolving buyer preferences. While challenges persist, the U.S. remains an attractive destination for international real estate investment, drawing buyers from diverse backgrounds and motivations.

Contact us at hello@gmg.asia and seize opportunities in the thriving U.S. property market. Visit www.gmg.asia for more information.

Australia has consistently been one of the strongest real estate markets for overseas buyers and continues to be despite the rate increases.

Here is a snapshot our GMG Australia+ mortgage program and what makes our loan program unique:

1. Land + Home

Traditional banks excel in downtown condos but shy away from construction loans, especially in suburbs and rural areas. GMG Australia+ loan program defies norms.

When banks say "NO," we say "YES."

2. High LTV

Unlike traditional lenders with caps on LTV ratios, GMG Australia+ takes a different approach. We offer up to 85% LTV for purchases and 80% for cash-out, exceeding the usual 75% cap that banks have.

Unlock investment potential with GMG Australia+!

3. Refi/Cash-Out

We have loan programs that allow borrowers to Refi/Cash-Out of Australia. This unique feature empowers you to tap into the equity of your Australian assets, granting you greater financial flexibility. Imagine accessing funds to fuel new ventures, expand investments, or fulfill personal goals. With GMG Australia+, you're not just securing a mortgage - you're gaining a tool to shape your financial future.

4. Transparency

Our new loan programs track RBA rates explicitly. While the RBA's cash rate stays at 4.1%, our non-resident loans are around mid-7%. Unlike banks like HSBC, whose loans are around 6.5%, their rates don't come down quickly with RBA changes - Not the case with GMG Australia+ mortgages!

5. Downloadable PDF

For detailed rates and terms of our GMG Australia+ mortgage programs please click here for the downloadable PDF.

For more information please contact Leonard Lee, Head of Australia, at leonard.lee@gmg.asia or +65 8282-5388.

In the tech world, you will hear terms like “platform” and why they are so valued by investors. These are the Amazons and Facebooks of the world and it's because once they cover their fixed costs, as their revenue grows, so does their profitability. It’s also called operating leverage.

In a way, so is owning an investment property with a 30-year fixed-rate mortgage. Your fixed costs are flat for 30 years (and if rates fall, you can refinance to a lower rate), but rental income and property values increase over time.

Rental prices, in particular, have been rising considerably, especially during the last 12 months, despite a rise in interest rates given the lack of property supply and also the marginal buyer who cannot own at 7% mortgage rates is forced to rent.

In a perverse way, the rate increases have made it a better environment to own an investment property, especially in states like Texas and Florida, where families prefer to migrate to, given low state taxes and affordable cost of living.

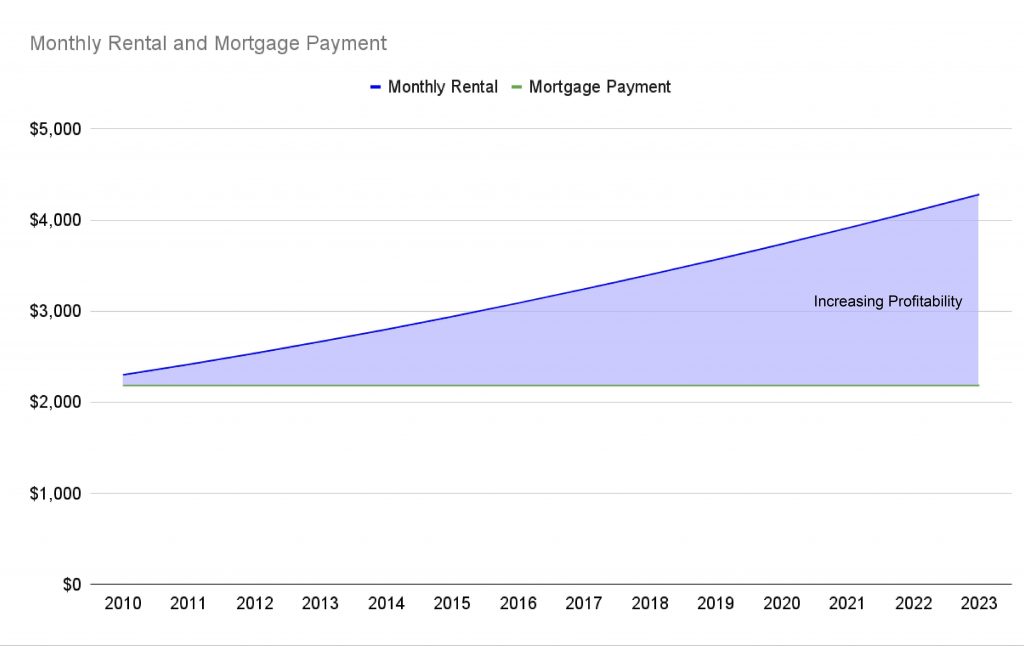

Here is a visual to explain this important point:

Amy, a savvy homebuyer living in Hong Kong, purchased her dream investment home in Los Angeles back in 2010. Recognising the benefits of a 30-year fixed-rate mortgage, she secured a loan at an interest rate of 5.25%. This meant that her monthly mortgage payment would be approximately $2,185.

As you can see, Amy's monthly mortgage payments have remained the same over the years, while rental prices have steadily increased. This has resulted in a significant financial advantage for Amy.

Only in the U.S.!

The United States is the only country in the world that offers homeowners a 30-year fixed-rate mortgage, which provides stability and predictability. This means that your monthly mortgage payments will remain the same for the entire loan term, even if interest rates fluctuate. This can be a huge advantage, as it gives you peace of mind and financial security. When interest rates do go down in the future, you can refinance your mortgage and take advantage of the lower rate. This could save you a significant amount of money over the life of your loan.

What are 30-Year Fixed Interest Rates?

A 30-year fixed interest rate is a mortgage loan with an interest rate that remains constant throughout the loan's entire term, typically three decades. This stability and predictability make it an attractive option for many homebuyers.

Advantages of 30-Year Fixed Rates:

Key Takeaways

Amy's case study shows that a 30-year fixed-rate mortgage can be a wise financial decision for foreign nationals who are buying homes in the United States. By locking in a fixed interest rate, Amy was able to protect herself from market volatility and ensure that her monthly mortgage payments would remain the same for 30 years. This gave her peace of mind and financial security, even as rental prices in her area increased.

Global Mortgage Group is a leading international mortgage originator specialising in offering customised financial solutions for residential real estate in the U.S., Canada, Mexico, U.K., France, Portugal, Spain, Italy, Dubai, Hong Kong, Singapore, Thailand, Philippines, Japan, and Australia.

Contact us at hello@gmg.asia to learn more. Visit www.gmg.asia for more information.

In the world of real estate investing, opportunities often arise that demand swift action and access to immediate liquidity. Whether it's seizing a lucrative investment, capitalising on a time-sensitive deal, or making cash available to expand your business, savvy investors need a financial solution that bridges the gap or "bridge" between the present and the future.

Enter real estate bridge loans – a powerful tool that provides experienced and sophisticated international real estate investors with the flexibility and speed they need to navigate the dynamic landscape of property transactions.

In this article, we delve into why real estate bridge loans are not only for the Ultra High Net Worth and now has emerged as an excellent option for anyone seeking liquidity – a true game-changer in the market.

1. Global Offering:

2. Speed and Surety:

3. Flexibility to Maximise Returns:

4. Mitigating Risks and Overcoming Hurdles:

5. Competitive Advantage:

6. Seamless Transition and Timing:

Conclusion

Global Mortgage Group presents real estate bridge loans as an excellent option for those seeking liquidity in the dynamic world of real estate. With the ability to facilitate swift transactions, offer flexibility, provide bespoke structure, mitigate risks, ensure seamless timing, and deliver a competitive advantage, these bridge loans have become an invaluable tool for investors.

While America Mortgages, a subsidiary of GMG, specializes in U.S. bridging loans, GMG's expertise extends worldwide through its offering of global bridging loans. Whether you're in the United States, Australia, Canada, U.K., Singapore, Hong Kong, India, Thailand, Philippines, Dubai, or anywhere else, GMG and its subsidiary, America Mortgages, are the trusted firms relied upon by investors worldwide. To learn more about our comprehensive financing solutions, visit www.GMG.asia or www.AmericaMortgages.com.

One of the biggest surprises for me this year has been how popular Japan has been as an investment destination. Whether it's a small condo in Ginza for an individual investor or a multi-unit apartment building in Roppongi for a family office - demand has been strong and consistent over the past 12 months, but especially over the last 6 months. I think part of it is the exchange rate, and the JPY is back on a weakening trend and close to the 5-year low of JPY 145 to the USD - but part of it is how affordable real estate is and the quality of the finished product.

In 2022 we created our “GMG Concierge Service” because more investors, namely family offices, asked us to source real estate for them alongside offering the financing. Although driven by demand from our clients, that decision proved to be a big winner for us as we successfully helped acquire 5 multi-family buildings in Tokyo over the past 12 months and are just getting started. Message me below to learn more.

We all know Japan is a popular tourist destination known for its vibrant cities, rich cultural history, and beautiful landscapes. This has made it a highly desirable location for property investments. In addition to these attractions, Japan also offers a number of other factors that make it a good investment market, including:

According to the Japan Real Estate Institute, the number of foreign national investors in the Japanese real estate market has increased significantly in recent years. In 2022, there were over 100,000 foreign national investors in the Japanese real estate market, up from just 50,000 in 2013. This growth is being driven by a number of factors, including the strong performance of the Japanese economy, the low cost of living in Japan, and the growing popularity of Japan as a tourist destination.

Foreign investors have been pouring money into Japanese hotels at a scale unseen in years. In the past 12 months, overseas buyers have invested a total of $3.7 billion in Japanese hotels, according to data from research firm MSCI Real Assets. This is the highest level of investment since 2014.

In the past year, overseas buyers made up 47% of hotel deals that closed in Japan, which is notable because hotels make up about a tenth of real estate deal activity in the nation, said Benjamin Chow, MSCI’s Asia head of real assets research. Foreign investors have historically been more drawn to residential or retail properties, but they are now increasingly interested in hotels as well.

Tokyo, Osaka, and Kyoto are the most popular destinations for foreign national investors in Japan. These cities offer a variety of investment opportunities, including residential properties, commercial properties, and land. Foreign national investors can also benefit from several government programs designed to attract foreign investment in the Japanese real estate market.

Japan real estate investment for International Buyers

If you are considering investing in Japanese real estate, GMG can help you navigate the market and find the right property for your investment goals. GMG offers a variety of mortgage products for international investors, including fixed-rate and variable-rate mortgages, as well as a variety of repayment terms. GMG also provides legal and tax consultation, property management, and purchase process guidance, making your investment journey smoother.

To learn more about investing in Japanese real estate with GMG, please visit our website, www.gmg.asia, or contact us today. We would be happy to answer any of your questions and help you get started on your investment journey.

GMG Concierge Service

GMG offers an exclusive concierge program that provides investors with access to a wide range of benefits, including:

To learn more about GMG's exclusive concierge program, please visit our website, www.gmg.asia, or contact us at hello@gmg.asia today.

Global Mortgage Group Pte. Ltd. is the world's leading international mortgage specialist. Based in Singapore with offices and partnerships across the globe, we connect our international clients to our network of lenders around the world. GMG offers financing solutions in the United States, United Kingdom, France, Canada, Australia and Singapore.