STAMP DUTY COMPARISONS FOR INTERNATIONAL REAL ESTATE INVESTMENT DESTINATIONS

For international real estate investors who intend to use the property to earn income, the numbers have to make sense. The definition of Stamp Duty is a tax that the government places on legal documents, usually involving the transfer of real estate or other assets, and having them legally record those transactions.

In reality, it's a tool governments use to control housing prices. When housing prices rise too aggressively, governments increase stamp duties to cool prices and vice versa if governments want to promote property purchases. In some countries like Singapore, stamp duty can be as high as 30% for first-time buyers - yes, 30% just to prepare some documents!

How It Works

When it comes to property transactions, stamp duty charges are typically based on the purchase price of the property and vary depending on the property's location, with some states and territories having higher rates than others. In addition, different rates may apply for different types of properties, such as residential or commercial properties. On top of property transactions, stamp duty charges can also apply to the transfer of shares and certain other types of transactions. The rate and applicable transactions can vary depending on the jurisdiction.

Overall, stamp duty charges are an important consideration for anyone, especially foreign national investors looking to buy property.

Global Comparison

Here's a list of stamp duties for the countries we offer mortgages to:

Australia:

- Stamp duty varies for each state in Australia but as a rule of thumb, it's 3-4% of the property value.

Canada:

- Canada has no stamp duty. Instead, the country imposes a tax on the occupation of properties.

- As of January 1, 2023, Foreign nationals are banned from purchasing property in Canada. The law provides exceptions for home purchases by immigrants and permanent residents of Canada who are not citizens.

Dubai:

- If the target company or a subsidiary holds real estate in the UAE, then registration fees would be payable. The rates vary depending on the emirate.

- In Dubai, a registration fee of 4% is payable on the value of the property where there is a transfer of either freehold title or a long-term lease of 10 or more years, with 2% being typically borne by the buyer and 2% by the seller.

France:

- The French government imposes a property transfer tax on the sale of real estate.

- The rate of tax varies depending on the location of the property and the type of transaction and can range from 2% to 12%.

Hong Kong:

- Ranging from HK$100 for properties under HK$2 million up to 4.25% of the sale price for property over HK$21,739,120.

- The stamp duty rate jumps to 15% for non-permanent residents and Hong Kong permanent residents buying a second property.

Italy:

- This tax is between 2% and 9% of the cadastral value of the house.

- However, it will never be less than 1000€ regardless of the value of the property.

- If you are buying from a private person, you do not pay any VAT. In addition, if this property is your primary residence in Italy and you spend more than 6 months per year in Italy, the tax will only be 2% of the property's value.

- On the other hand, if this is your second property and you are not a permanent resident, this tax rises up to 9% of the cadastral value.

Japan:

- 3% of the sales price + 60,000 yen + consumption tax in accordance with property transaction regulations.

- For registering ownership transfer or mortgage on a property.

- Fee for conducting ownership transfer and necessary related registration.

Portugal:

- The duty is paid by the buyer and charged at a fixed rate of 0.8% of the property's registered fiscal value.

- Stamp Duty is charged for all documents and arrangements in respect of real estate, including deeds, contracts, and mortgages.

Singapore:

- Singapore Citizens: The second (17%) subsequent (25%) property purchases.

- Singapore Permanent Residents (SPRs): On all purchases, rates start from 5% for the first purchase. The second purchase will be 25% third, and subsequent purchases will be at a rate of 30%.

- Good news! Under the respective FTAs, Nationals or Permanent Residents of the following countries will be accorded the same Stamp Duty treatment as Singapore Citizens: Nationals and Permanent Residents of Iceland, Liechtenstein, Norway, or Switzerland and Nationals of the United States of America.

- Foreigners: 30% rate for any property purchase.

- Entities (companies or associations): 35% for each property (plus an additional 5% non-remittable ABSD for developers)

Spain:

- Stamp duty at 1.5% of the purchase price.

Thailand:

- There is a stamp duty if signing or bringing original share transfer documents into Thailand, which is 0.1% of the paid-up value or of the purchase price, whichever is higher.

- The parties can agree that the buyer is solely responsible for stamp duty payment or that the stamp duty be shared between both parties.

- Unless agreed otherwise, the seller is responsible for stamp duty payment.

United Kingdom:

- First-time buyers pay no SDLT on purchases up to £425,000

- First-time buyers pay 5% SDLT on the portion from £425,001 to £625,000

- Second-home purchases attract a 3% premium for valuations over £40,000

United States:

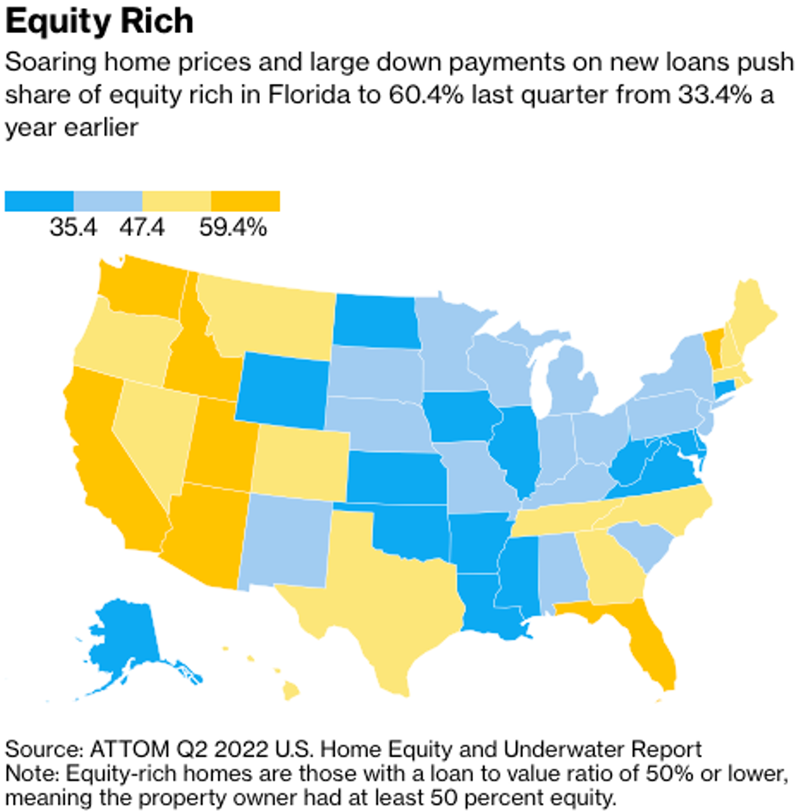

- There is no stamp duty in the United States.

In Summary

Stamp duty rates vary greatly across the globe, and it's important for investors to be aware of the costs associated with purchasing property in different countries. While some countries have relatively low stamp duty rates, others have very high rates that can significantly increase the cost of purchasing property. As you can see, the United States has no stamp duty compared to other countries like Dubai, U.K., or Australia. It's important for investors to factor in stamp duty costs when comparing investment opportunities in different countries.

GMG has a team of qualified professionals who can help navigate the process and provide guidance on the costs associated with purchasing property in a specific country. By considering stamp duty and other costs, foreign national investors can make more informed decisions and potentially save thousands of dollars on their real estate investments.

Get in touch with us to learn more about global real estate investing and all about GMG's financing solutions for foreign national investors today. hello@gmg.asia