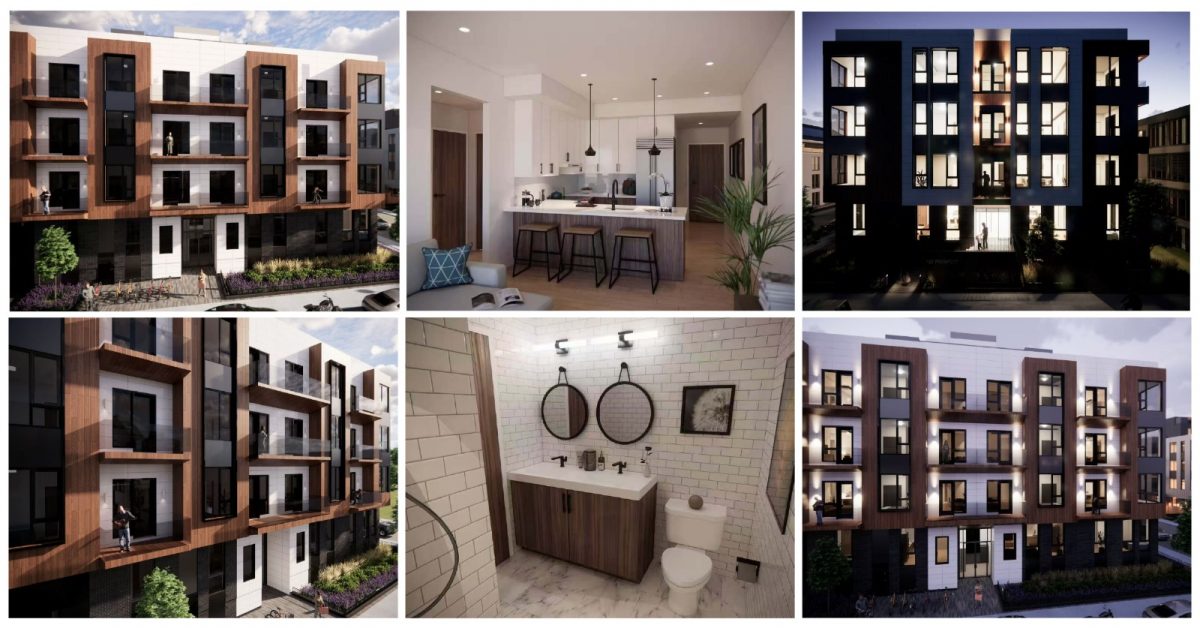

[Super Rare] New Boston condos for sale – only 13 units left!

Act Fast: Rare New Boston Condos Hitting the Market Now There are missed opportunities. And then there’s missing out on the only new condo development in Cambridge, Boston, right next to Harvard and MIT. For global investors, this isn’t just another property launch. It’s a rare chance to own real estate in one of the most competitive…